Since 2010, the stock market, as represented by the benchmark NSE20 Index, performed its best in March 2015 reaching a high of 5,499.64, and its worst this October 2018, slumping down to 2,782.97. And it will probably fall some more.

I do not attempt to explain why the market behaves the way it does. Not only have I read enough on the subject of forecasts, but I have been around the markets long enough to know by experience, that silence is the best way to spare myself some egg on my face. I too have learnt that the best indicator for a view on the market is not an “experts” analysis, but rather their action.

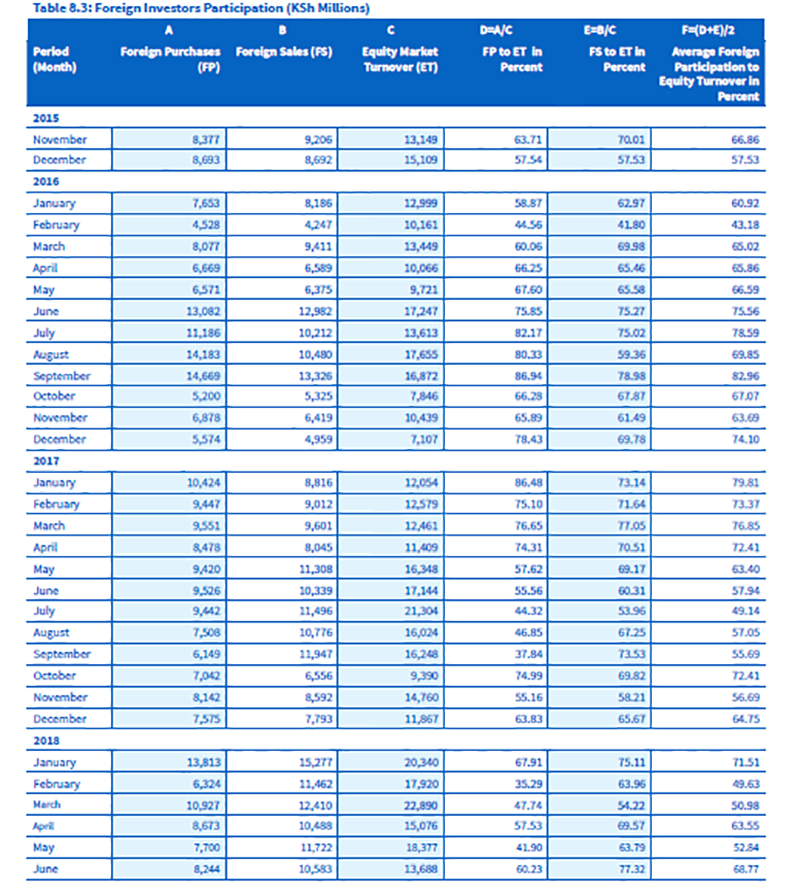

In trying to satisfy my curiosity as to what could be the likely source of the decline, I came across CBK’s Monthly Economic Indicators report which shows that foreign investors, making up more than 50% turnover activity at the NSE have been on a net sales position literally every month from mid-2017 (see table below). When a significant segment of the market is in offload mode, then what results is high supply, leading to falling prices. I have not ventured a theory as to why they are exiting the market.

My reading and experience has taught me that markets are cyclical, based sometimes on actual economic fundamentals, and at times on irrationality. Other than the unpleasant news-making matte of our national debt, nothing points to a catastrophe in the Kenyan economy. With GDP growth forecast by most significant players to cross the 6% mark, a political atmosphere better than we have enjoyed in a long while, some three years before election campaigns hit fever pitch, and the scare to the corruption networks as a result of the ongoing crackdown, the economy looks promising.

I do not see what would stop me from taking a positive medium-term position on this economy (3 or so years), except my lack of funds to invest. That is why I will have a positive outlook towards this market, especially for the stocks whose fundamentals are strong. I still favour banks, with Equity Bank remaining a favourite. The stock was of good value when it was trading above 50 shillings, surely at the mid thirties and forties, it is even better value — nothing about the company has changed.

“One of the reasons we don’t profit from stock market slumps is our fixation with the “loss” we have made on the stock we purchased high, whose price is now low. It helps to avoid that trap.”

One of the reasons we don’t profit from stock market slumps is our fixation with the “loss” we have made on the stock we purchased high, whose price is now low. It helps to avoid that trap. Worst case, the stock will not recover and your historical loss sticks with you. It is what is called a sunk cost. Best case, the stock recovers and you reduce your historical loss while you record profits on the stocks you bought during the slump. If for some reason the market recovers to its highest level in whatever period of time, those buying now will book in gains of close to 100%.

Wishing you the courage to take the plunge.

This article, written by Palmer Thambu, originally appeared on Kellie Murungi’s blog The Rookie Manager. Read the original version here.

*Flowers to Kellie and Palmer for sharing this article with us!