About Us

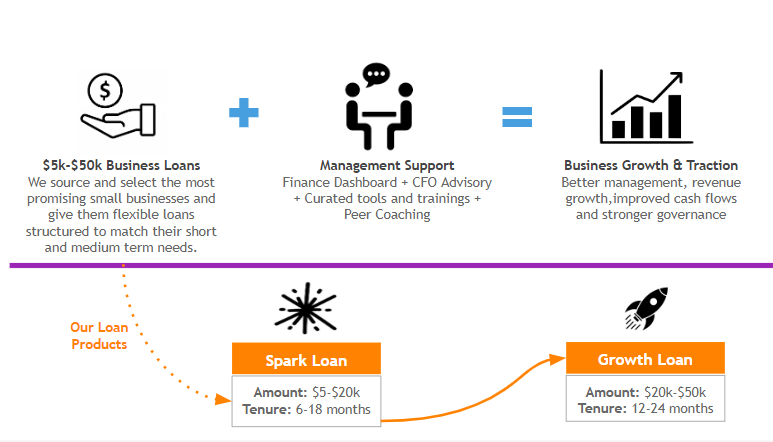

SHONA Capital provides local SMEs with affordable and flexible loans to help them grow and achieve their full potential. Our financing is combined with hands-on management support from our team and preselected industry experts, experienced entrepreneurs and other relevant subject matter experts.

What We Offer

Flexible Business Loan

We offer flexible business loans to finance immediate growth opportunities, validate your business model and give you the peace of mind to develop a concrete plan to achieve your medium term to long term business goals.

Loan Amounts range from $5,000-$50,000

Management Support

We understand that growing a business locally requires more than money! Our skilled staff and team of preselected experts will support you to solve critical bottlenecks in finance, sales and operations to optimize your growth and profitability.

We also know that entrepreneurs are the experts in starting and growing businesses. We curate strong relationships and peer learning among our portfolio businesses and ensure that they brainstorm solutions to each others’ challenges, share opportunities, refer clients to one another, collaborate through partnerships, and support each other emotionally.

How It Works

Step 1: Expression of Interest

Schedule a conversation with our team here. We shall follow up and schedule a 30 min meeting to learn about you, your business and your needs.

Step 2: Loan Application and Review

- We shall send you a simple loan application form to collect basic information about the business.The application form takes about 1-2 hours to complete.

- Once we receive your application, our team will spend about a day analyzing your financials and business plan and working with your team to develop key performance indicators that will enable us to track your progress. This analysis will be available to you regardless of our loan decision.

Step 3: Loan Approval and Disbursement

Once the loan is approved, we shall send you an offer and loan agreement within 10-14 working days

after submitting your application. Funds will be disbursed within 3-5 working days after signing the agreement.

Step 4: Execution and Business Support

We shall support you to implement the business plan during the term of the loan.

Step 5: Evaluation

Repaying the initial loan in full and on time qualifies your business to receive more support in the form of a larger growth loan and higher value business support services including accounting and tax services, executive coaching, a dedicated industry expert among others.

Do I Qualify?

To qualify for a loan from this loan facility, a business must meet the following basic criteria

- Registered business with at least 2 full time employees including yourself

- Operating for at least 2 years

- Generated at least $10,000 (ushs36,000,000) in revenue for the last 12 months

- An aspiration to grow the business at least 2x in the next 1-3 years.